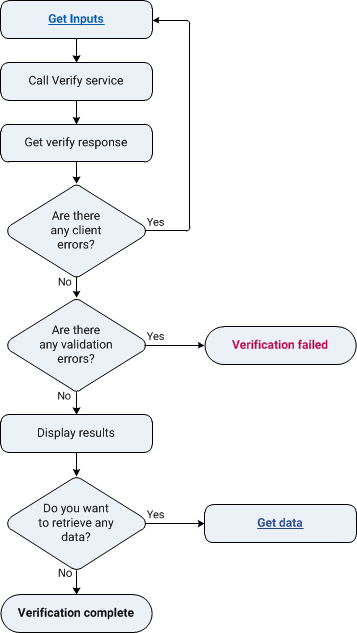

Call Verify service

To verify account details, you need to call Verify, supplying the account details, check context, and either the personal details or the company details, or both.

Before passing the details to the Absolute service for verification, Bank Wizard validates the account details.

Get verify response

To find out the result of the validation and the verification, you need to retrieve the verification response. The response always includes the conditions returned by Bank Wizard. These conditions show whether validation was successful and whether the account details were reformatted.

If the validation was successful, the response also includes the verification scores and the transposed account details.

VerifyResponse verifyResponse = hostedService.Verify(verifyRequest);

Are there any client errors?

Client errors are returned if you have not supplied the correct data or the data is not in the correct format. If you receive any of these errors, you should re-prompt the user for the incorrectly formatted or missing information and then call Verify again.

Are there any validation errors?

You need to check the returned conditions for errors. If any of the conditions are errors the validation has failed and the details will not have been verified.

Depending on your business rules, you may also need to check the conditions for specific warnings that you want to treat as errors. For example, if you are setting up a Faster Payments transaction, you must reject the details if Warning 100 - This bank branch does not accept FPS payments is returned. However you can ignore this condition if this is a standard credit transaction.

|

|

Warnings do not stop the account and personal details being verified. |